The world’s first non-cellular 5G technology standard is available, with a higher node density than NB-IoT and LTE-M connections.

Recently, the DECT-2020 NR standard launched by the European Telecommunications Standardization Society (ETIS) was recognized by the International Telecommunication Union (ITU) and incorporated into the IMT-2020 technology recommendation as part of the New 5G standard, which is the world’s first non-cellular 5G technology standard to provide a complete set of standards for the deployment of 5G private networks in the industry.

In the 5G era, private deployment of private networks for various industries has become a typical business model, and various technologies and standards for private networks have a broader scope of use.

Non-cellular 5G technology is focusing on uRLLC and mMTC scenarios.

DECT, known as Digital Enhanced Cordless Telecommunications (DECT), was introduced in Europe in 1987 and has a history of more than 30 years of development, almost as long as public mobile communications.

Operating in the 1880-1900 MHz band, the standard enables high voice quality and security, was originally intended to enable flexible digital wireless communications in residential, commercial, and public environments, and has been implemented in over one billion short-range communications devices worldwide.

Over time and with the development of public mobile communications, DECT has evolved to be able to support Internet data communications as well as IoT communications, in addition to voice communications.

For example, in 2013 ETSI had experts propose a low-power version when the technology was aimed at smart home applications, and in several overseas countries, DECT was used in some scenarios of home energy management automation, but compared with Zigbee, Z-WAVE, etc., it was not yet possible to form a substitute.

DECT-2020 NR is the latest version of the DECT standard released by ETSI in October 2020 and can be deployed in local networks, public clouds, or any other form of network architecture in between.

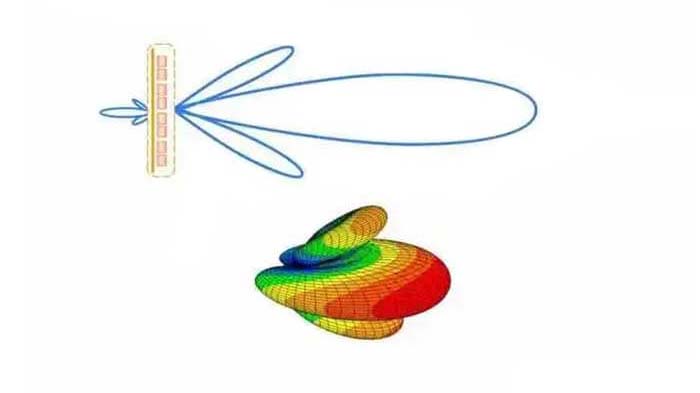

According to the technical specifications published by ETSI, the main scenarios for DECT-2020 NR applications include highly reliable point-to-point as well as point-to-point link configurations.

Star-based network topology local wireless access supports uRLLC scenarios, and mesh-based self-organizing network topology local access supports mMTC scenarios.

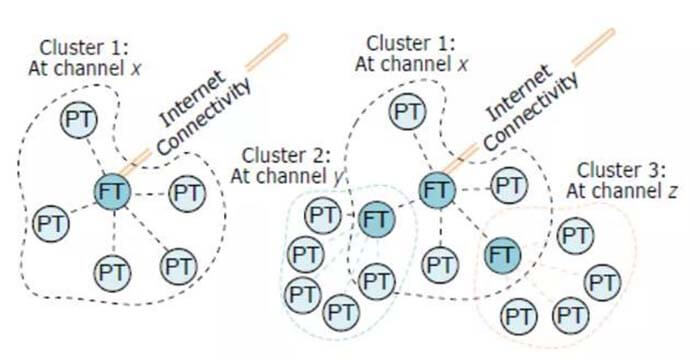

It can be seen that DECT-2020 NR is more oriented to 5G IoT industry applications. Among them, MESH networking is the biggest highlight of this version of the “non-cellular 5G standard”, with the advantage of mesh communication to achieve massive connectivity and meet the 5G mMTC targets proposed by ITU.

An article published by Finnish wireless communication experts in IEEE Communications magazine shows that DECT-2020 NR has a higher density of connected nodes compared to NB-IoT and LTE-M technologies incorporated in 5G with the same latency and packet loss requirements.

Self-assembling network architecture for DECT-2020 NR

ETSI experts point out that in a non-cellular 5G network, each device is a node and each device can be a router as if each device is a base station.

Devices will automatically find the best route, and automatically add new devices to the network route, and if one device fails, those devices will reroute themselves, meaning reliable communication eliminates single points of failure.

A decentralized network with low transmission power means less energy consumption and a Finnish university study showed that the system network is about 60% more energy-efficient than a traditional cellular network topology with the same transmission efficiency.

In addition to the established 1900 MHz DECT band, the DECT-2020 NR physical layer is available in 17 bands up to 6 GHz. Dynamic channel selection means that DECT-2020 NR does not require frequency planning and the complexity of the front-end is relatively low.

In addition, the DECT-2020 NR specification also proposes ways to be compatible with 3GPP 5G standards, in particular by supporting access to the 3GPP 5G core network, e.g. through N3IWF (Non-3GPP Interworking Function) in the 5G core network. This flexibility also provides ease of deployment for industry-specific networks.

Non-Cellular 5G Technologies Reaching the $12 Billion Private Network Market

DECT-2020 NR offers a new option for global industry leaders looking to deploy independent private 5G networks on their own. The global race for 5G private networks is now open, and the private network market will be far larger than it was in the 4G era, with industries investing real money in the space.

Market research firm Juniper Research recently released a report showing that the various enhanced capabilities of 5G are driving enterprise enthusiasm and awareness for private networks, with global annual spending on private network hardware and services set to reach nearly $12 billion by 2023, up 116 percent from an estimated $5.5 billion in 2021.

Of this, 5G plays a key role in this aspect of private networks, with 5G base stations accounting for more than 60 percent of the base stations used in private networks deployed in 2023.

Of course, one of the biggest barriers to deploying a 5G private network is the ability to access legal radio frequency resources. Because the management policies for radio frequencies vary greatly from country to country around the world, this has led to the very uneven development of 5G private networks worldwide.

It is well known that Germany has taken the lead in introducing a dedicated radio frequency support policy for 5G private networks, opening up very cheap and easy applications for private network frequencies, and a large number of industrial companies have been authorized for 5G private network frequencies.

The U.S. has formed an authorization policy for 5G private network frequencies through CBRS bands; Japan, South Korea, and the U.K. have also introduced different forms of policies.

Juniper Research believes that the uneven state of 5G private network deployment is evident globally, with the largest markets being those with the most open or flexible frequency allocations.

Germany and the U.S. form the lead in this area, with these two countries set to account for a 30 percent share of global private network spending in 2023, a share that is likely to decline as other countries release spectrum for private network use.

In the industry sector, industrial and energy-related companies will be the core users of private network investments, accounting for nearly 60 percent of the investment market share by 2023.

However, Juniper Research also points out that despite the dominance of traditional operators in public cellular networks, they are likely to miss out on most of the private network market.

Communications equipment vendors such as Ericsson and Nokia, on the other hand, can provide private network equipment directly to large industrial users, capturing some of the benefits of private network investments.

Therefore, in the future global 5G private network market, a large number of new “operators” will be formed, and these operators will mainly provide network operation services for vertical industry users.

Some of these industry customers may set up their own teams with communications network operation capabilities to serve their own private networks, or they may outsource this operation service to third-party service providers.

Given that private networks will become a new industry in the 5G era, several standardization organizations and industry chain enterprises are continuing to promote the commercial implementation of technologies and products for private networks.

3GPP has also absorbed the research results of several organizations and members, such as the 5G-ACIA multi-defined private network scenario, to promote the development and evolution of NPN (non-public network) standards.

Currently, China’s 5G is under rapid construction, and for 5G private networks, no 5G private network frequency policy has been launched yet, so it is impossible to realize a completely independent 5G private network landing, but more focused on the “public network dedicated” mode.

In July 2021, ten ministries jointly released the “5G Application “Sailing” Action Plan (2021-2023)”, in which “strengthening the guarantee of 5G frequency resources” measures, were clearly put forward: to carry out 5G industry-specific frequency requirements and In the action plan, it is clearly proposed to conduct research on the requirements of 5G industrial dedicated frequencies and the compatibility of other radio systems and to study and formulate a suitable licensing model and management rules for the use of 5G industrial dedicated frequencies in China.

The introduction of independent 5G private networks seems to take some time, while major operators actively launch products related to public-private networks, opening the way for the development of 5G private networks with Chinese characteristics, covering models from network slicing to independent private networks, of which independent private networks are actually realized by renting operators’ frequencies.

In 2020, China Mobile released a 5G private network product system, including three modes of “superior, exclusive, and premium”, and has completed more than 1,500 commercial 5G private network projects in various industries since a year ago. Recently, China Mobile released 5G private network product system 2.0, based on the 1.0 system, the new system focuses on 18 sub-sectors such as factories and mines.

With the acceleration of 5G commercialization, there will be a hundred contentions for 5G private networks. The release of the world’s first non-cellular 5G standard by ETSI is to add bricks to the 5G private network ecology at the standard level, which will surely be implemented in some industries in the future and also give birth to a rich group of 5G private network innovation groups.

Besides the What is Non-cellular 5G Technology article, you may also be interested in the below articles.

LTE Vs. 5G: Is 5G Better Than LTE?