After the development of the past few years, the 5G NB-IoT industry in China has been ahead of the international for 2-3 years, and the application of the head industry has entered a mature stage, new application fields are continuously being expanded, and related products are becoming more and more abundant.

In the future, the market awareness of 5G NB-IoT will also become higher and higher, and it will still be able to maintain rapid development within 2-3 years, and then enter a stable period of development.

Although there are many 5G NB-IoT-related reports on the market, we still hope to provide readers with more perspectives, more detailed explanations, and more comprehensive content.

Therefore, in order to facilitate more people to have a comprehensive and clear understanding of the 5G NB-IoT industry, we conducted in-depth research on more than 10 domestic 5G NB-IoT first-line representative companies, covering the entire industry chain.

China’s 5G NB-IoT market industry research report, the report mainly focuses on the domestic 5G NB-IoT industry to carry out a comprehensive combing, showing a clear 5G NB-IoT industry chain, typical applications, and the latest market conditions.

5G NB-IoT basic introduction

The full name of NB-IoT is Narrow Band Internet of Things. It is a more streamlined new terminal communication technology for the Internet of Things proposed by 3GPP R13 on the basis of mature commercial LTE technology.

It is to achieve the requirements of large connections, wide-coverage, and low power consumption. The narrowband wireless cellular communication technology designed specifically for the Internet of Things can be deployed in NR in-band to support access to the 5G core network.

In July 2020, ITU officially accepted NB-IoT as a key component of 5G mMTC (large-scale Internet of Things communication).

Therefore, some practitioners in the industry are more willing to call NB-IoT 5G NB-IoT. In fact, the two concepts refer to the same technology.

From the perspective of technical capabilities, 5G NB-IoT has outstanding performance in the following aspects, which meets the needs of 5G mMTC services. The network capabilities of 5GNB-IoT are as follows:

| 5G NB-IoT network capabilities | |

| Characteristic | Parameter |

| Uplink and downlink transmission rate | Uplink: more than 160KBps, less than 250KBps (Multi-tone) /200KBps (Single-tone) Downlink: greater than 160KBps, less than 250KBps |

| Capacity | A single base station cell can support 50,000 terminal access nodes |

| Coverage | Compared with GPRS base stations, 5G NB-IoT increases the gain by 20dB, which is equivalent to increasing the coverage area capacity by 100 times and can penetrate 1-2 more walls. |

| Mobility | 5G NB-IoT supports cell reselection of terminal equipment at a certain rate of 30km/h |

| Power saving mode | 5G NB-IoT introduces PSM and eDRX power-saving modes. The former achieves power saving by not accepting paging messages when in sleep, and the latter saves power by setting a longer paging cycle |

| Channel complexity | 5G NB-loT streamlines unnecessary physical channels. There are only three physical channels and two reference signals in the downlink, and only two physical channels and one reference signal in the uplink. |

5G NB-IoT background and market overview

5G NB-IoT industry background

Based on the huge number of connections, it can drive the transformation of a larger market output value, and major research institutions are also very optimistic about the forecast of the output value of the Internet of Things market.

5G NB-IoT technology background

With the rapid development of the Internet of Things, the problem that these communication technologies cannot effectively carry a large number of low-to-medium-speed Internet of Things connections has become more and more obvious, and these technologies also have certain deficiencies in coverage and security.

A series of low-power wide-area network communication technologies specially optimized for transmission rate, coverage, capacity, etc. have emerged as the times require. Among them, 5G NB-IoT uses low power consumption, large connection, low cost and other performance advantages, thereby driving the rapid implementation of IoT applications in smart cities, asset tracking, sharing economy, smart home and other fields.

5G NB-IoT demand background

2G/3G applications require new technologies to undertake: For many reasons, 2G has been withdrawn from the network due to its low profitability, high maintenance costs, power consumption and spectrum utilization disadvantages, and other reasons.

The three major operators have successively carried out actions to withdraw from the network, and the Ministry of Industry and Information Technology officially issued a document clearly stating that it should guide new IoT terminals to no longer use 2G/3G networks.

The price of NB-IoT terminals is lower:

After years of development, the price of 5G NB-IoT modules has tended to or even lower than the cost of 2G modules.

Coverage and power consumption:

From the theoretical point of view, the coverage and power consumption of 2G/3G/4G/5G base stations are not as good as those of LoRa and Sigfox technologies. Therefore, operators have introduced a method that can compete with these unlicensed technologies in terms of coverage and power consumption. Technology on par with technology is essential.

Introduction to the latest progress and evolution trend of 5G NB-IoT technology

The initial R13 version of the 5G NB-IoT standard began and is continuously evolving. Up to now, 3GPP has started the evolution of the R17 version.

| The evolution of each version after 5G NB-IoT R13 | |

| Standard version | Evolution content |

| R14 | R14 has been comprehensively improved in terms of network coverage, concurrency, uplink, and downlink rates, carrier capacity, mobile performance, and positioning capabilities. The specific performance is: 1. The uplink and downlink rate is increased to 125/140kb-ps, and the measured rate of R14 is 3-5 times higher than that of R13; 2. Support base station positioning, that is, the terminal measures and calculates the signal time difference between multiple base stations on the Baodingwei server, the theoretical accuracy can reach 50m; supports business interruption resuming transmission, but for the terminal side, cell reselection and handover is still not supported ; 3. Use multicast enhancement to achieve lower end-to-end delay, and use a multi-carrier enhancement to improve paging capacity and network access capabilities; 4. The test data shows that the delay of R14 can reach the level of 2G. In many environments, the average delay of NB-IoT is lower than 2G, and the transmission delay of large packets is shortened by more than 30%; 5. Support lower transmit power level -14dBm; 6. Improved mobility to 80km/h, which can match the communication rate of GPRS. |

| R15 | 1. Enhance downlink control, improve the reachability of downlink messages, enhance interoperability, and realize mutual cell reselection; 2. Starting from the R15 version of 5G NB-IoT, inter-network reselection to LTE can be done, including eMTC and 2G inter-network reselection; 3. It can support the coexistence of the 5G NB-IoT and NR air interface. |

| R16 | The R16 version will support 5G NB-IoT access to the 5G core network. |

| R17 | The uplink and downlink rates are further enhanced, the downlink is enhanced from 128kbps to 280kbps, and the uplink is enhanced from 158kbps to 210kbps; the mobile performance in the scenario of frequent data packets is greatly improved. |

5G NB-IoT connections

As early as October 2020, the number of global 5G NB-IoT connections has reached 140 million, and the Chinese market alone has already exceeded 100 million.

5G NB-IoT base station construction

As of the end of 2020, my country has built more than 900,000 5G NB-IoT base stations, which constitute the main body of 5G NB-IoT wide coverage and infrastructure.

5G NB-IoT network coverage

According to GSMA statistics, as of September 2020, a total of 97 5G NB-IoT networks have been deployed globally, of which 30 networks support both 5G NB-IoT and eMTC, and have been applied to more than 50 services in more than 40 industries.

As far as China is concerned, continuous coverage has been achieved in major cities, townships and above in the country, laying a good network foundation for the development of various applications, and driving the continuous acceleration of the development of 5G NB-IoT related industries.

5G NB-IoT application overview

Chinese chip modules and industry applications have become mature, and the first applications of 5G NB-IoT gas meters and water meters have been accelerating, and both have exceeded 20 million applications;

5G NB-IoT applications such as smoke detectors and electric vehicles are rapidly increasing, and are currently close to 10 million.

In addition, more and more industries have joined the 5G NB-IoT camp, presenting a large number of million-level applications such as shared white electricity, smart street lights, smart parking, smart agriculture, smart door locks, and smart tracking. At present, it is expanding from point to surface to the whole country.

Analysis of the characteristics of the 5G NB-IoT industry chain

Since its development in 2014, the development of 5G NB-IoT in my country has gone through multiple development stages: budding period, trial period, development period, and mature period.

| Analysis of the characteristics of the development stage of the 5G NB-IoT industry | ||

| Period | Years | Characteristic analysis |

| Infancy | 2014-2015 | International giants such as Huawei, Qualcomm, Vodafone, Nokia and other international giants began to take the lead in researching prototype technologies, and finally established NB-IoT as the only band cellular IoT standard for narrow networks |

| Trial period | 2016 | The official freezing of NB-IoT core standards is a milestone event in the development of 5G NB-IoT. Since then, 5G NB-IoT has ushered in a development inflection point, market education has begun, and 5G NB-IoT applications have begun to enter the trial period. At this stage, most companies are verifying the feasibility of the practical application of 5G NB-I0oT, and the volume is generally very small. |

| Rapid development period | 2017-2020 | The application of 5G NB-IoT is growing rapidly, and the vertical field represented by smart meters has begun to be applied on a large scale, and it has begun to expand in all walks of life. The policy dividend, coupled with the development of giants such as operators and Huawei, has led to rapid development of 5G NB-loT in China. At this stage, some of the earlier developed subdivisions have also begun to realize the advantages and Feasibility, the early market education has been brought into play. |

| Stable development period | 2020-present | In some application areas, such as metering applications, 5G NB-IoT can be said to have basically reached a mature state. However, it is still developing in other fields, and even just beginning to develop. But overall, after the previous years of hard work, the development of 5G NB-IoT has entered a stable period. |

China's 5G NB-IoT industry chain challenges and development trend analysis

Problems and challenges outside the industry:

LTE-Cat. 1

LTE-Cat. 1 will become the main competitor of 5G NB-IoT. The main reasons are:

- Both are cellular network connection technologies, and they are almost the same in terms of network quality and coverage. Since both are low-to-medium-speed connection technologies, the terminal costs are also relatively close, which will result in the business overlap.

- Compared with 5G NB-IoT, LTE-Cat. 1 has stronger capabilities in mobility, transmission speed, voice calls, etc., and has more applicable scenarios. Under the background of the era of 2G withdrawal, it needs There are new technologies to fill in. At present, 2G applications mainly include POS machines, children’s watches, shared devices, etc., and these scenarios are more suitable for LTE-Cat. 1.

- Of course, NB-IoT also has its own unique advantages, that is, low power consumption and cost-effectiveness. In scenarios where the amount of data is small, the transmission frequency is not high, and the mobility requirements are not high, NB-IoT is the most cost-effective.

Other long-distance transmission technologies

It is mainly LoRa technology. As a technology that was commercialized earlier than NB-IoT, LoRa technology has long accumulated a large number of enterprises and applications in the low-power WAN market.

However, LoRa is naturally different from cellular networks due to the nature of its private network. After years of exploration, LoRa technology is currently mainly used in enterprise-level scenarios with poor public network coverage or data privacy requirements in China. It is expanding in the direction of indoor home furnishing applications.

And domestic long-distance transmission technologies such as ZETA and Chirp-IoT are currently also widely used in the market, and their market positioning is similar to LoRa. Although in terms of technical characteristics, they are relatively similar to 5G NB-IoT, the differences in network operations can also form a certain complementary relationship in the market.

Problems and challenges within the industry:

Chips

How to improve the adaptation of 5G NB-IoT chips to actual applications is not easy; in addition, 5G NB-IoT chip companies currently have more and more players in the market, and competition will become increasingly fierce.

Modules

There are many 5G NB-IoT module companies. We can find hundreds of module manufacturers through public channels. However, in fact, there are not many module companies with large-scale applications and shipments.

The issue of homogeneity of group products and price competition has long been the consensus of the industry, especially small module manufacturers, there is no reliable guarantee for subsequent product iteration and operation support, which has the risk of negative effects on application development.

Networks

On the one hand, although the three major operators have built more than 900,000 5G NB-IoT base stations across the country, the coverage rate is still far from enough. After the base station construction adopts on-demand construction, the network coverage rate will also move toward more precise direction development;

On the other hand, even if the operator turns on the high-frequency service function, the annual 5G NB-IoT tariff can be increased to 35-40 yuan, but the direct income contribution to the operator is still very limited. It is a high-input and low-output business.

Applications

One is that the application is too fragmented, the degree of concentration is not high, and it is difficult to form large-scale applications, and each sub-field needs to invest money, energy, and time to verify its feasibility. At the same time, the input and output cannot be guaranteed in the early stage. To a large extent affect the enthusiasm of enterprises to invest in a certain field;

The second is that many small-scale use cases are still not mature enough to develop into a clear application field. The product side has entered the state, and the application side is still in the process of exploring.

5G NB-IoT application analysis

From the perspective of application scenarios, China’s 5G NB-IoT application areas are distributed as follows:

| Application maturity | Category | Typical application scenarios | Business characteristics |

| Head application | Smart meter | Water meter, gas meter, electric meter | Large scale, wide terminal distribution, harsh environment |

| Mature application | Smart Fire | Smart smoke, etc | Widely distributed terminals, strong penetrability, and relatively high wake-up speed requirements |

| Smart City | Smart street lights, smart manhole covers, smart parking, etc | A wide distribution of terminals, strong penetration, large market scale, and closely related to urban construction | |

| Growth application | Sharing economy | Shared bicycles, unmanned vending, crane machines, etc | Fast growth rate, large potential market size, certain mobile demand, lower terminal distribution, and relatively higher wake-up speed requirements |

| Smart home | White goods, smart door locks, etc | Have certainly added value and information value | |

| Asset tracking | Pet location tracking, luggage tracking, etc | Possess a certain degree of mobility and wide distribution of terminals | |

| Smart agriculture | Electronic ear tags, agricultural environmental monitoring, etc | A wide distribution of terminals and large potential market | |

| Smart medical | Pillbox positioning tracking, wireless blood pressure monitor positioning, etc | A wide distribution of terminals and certain mobile needs | |

| Environmental test | Water quality monitoring, air quality monitoring, etc | The terminal is widely distributed, the potential market is large, and it is closely related to the people’s livelihood |

5G NB-IoT industry market operation analysis

In the shipments of 5G NB-IoT chip vendors in 2020

We conducted a survey and evaluation of the shipment volume of 5G NB-IoT chips in the Chinese market.

- In the survey, we estimated that the shipment of the chip market in 2020 will be about 70 million, of which Huawei accounts for more than 50% of the market share, while Ziguang Zhanrui and MKT are closely following.

- Among other manufacturers, domestic chip companies such as MobileCore Communications, Xinyi Information, Zhilianan, etc. have a certain amount of shipments. In addition, Qualcomm also has a small number of domestic shipments, and Qualcomm’s chips have a certain amount in the overseas market.

5G NB-IoT module shipment introduction

In this survey, we evaluated the shipment volume of 5G NB-IoT modules from 2017 to 2023:

- From 2017 to 2019, the shipment volume of 5G NB-IoT modules has a period of rapid growth, with a growth of several times each year.

- In the first half of 2020, due to the impact of the epidemic, although the construction of 5G NB-IoT basically resumed in the second half of the year, the growth rate was still affected to a certain extent.

- In 2020, the Ministry of Industry and Information Technology clearly stated that in the future, new NB-IoT base stations will be built on demand. This move will also have a certain impact on the growth of 5G NB-IoT shipments.

At present, the largest application of 5G NB-IoT is in the field of meter reading. With the increase in the penetration rate of the meter reading market, the overall growth rate of 5G NB-IoT will slow down. It is expected that in the next few years, 5G NB-IoT modules Shipments will maintain a growth rate of about 30%, and in 2023, module shipments in a single year will exceed 100 million.

Introduction to the proportion of 5G NB-IoT in 2025

As of the end of 2020, the number of Internet of Things connections of the three major domestic operators is approximately 1.2 billion. As 2G and 3G are withdrawn from the network and will be undertaken by LTE-Cat. 1 and NB-IoT, cellular IoT devices in 2025 will be mainly carried by 5G, 4G, LTE-Cat. 1 and 5G NB-IoT, of which 5G NB- IoT accounts for 35%, and there is plenty of room for growth.

Since 2G/3G has now entered the phase of de-netting, even if it is not fully de-netted by 2025, it will be ignored here.

5G NB-IoT market industry scale analysis

In this survey, we integrated the industry information we have learned to evaluate the current application output value of the entire 5G NB-IoT industry.

- This table evaluates the application output value of 5G NB-IoT in the domestic market and does not include the input-output value of networking. The application side evaluates the value of the product terminal hardware with NB-IoT as the core and the value of data flow and data application derived from this. We comprehensively consider the price changes of the terminal product and the increase in the proportion of data derived value.

- The multiple growths of application output value in 2017-2019 is mainly due to the large-scale deployment of connected applications, while the growth in 2019-2021 is relatively flat, mainly due to the price reduction of terminal products; the faster growth rate in 2021-2023 is mainly due to the smooth price drop, and the increase in the proportion of data derived value.

5G NB-IoT industry market price analysis

The price of my country’s 5G NB-IoT chips and modules has been investigated. The data on the price of 5G NB-IoT chips and modules shows that terminal applications and solutions are greatly affected by industry differences. Do not analyze at this time.

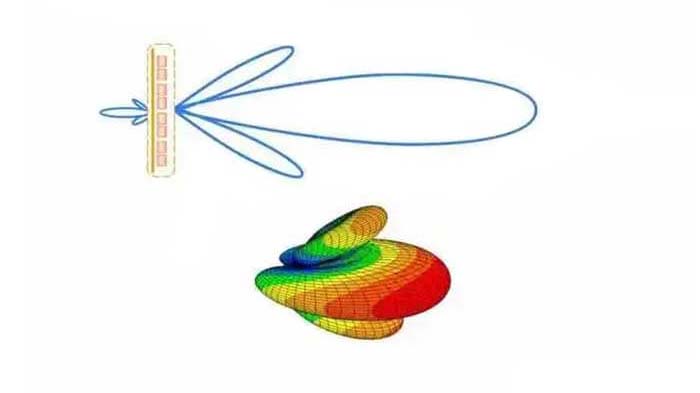

If you have any antenna questions, please read our ANTENNA FAQ section, if you still cannot get the answer you need, please contact us.

You may also be interested in the below articles.